Gold Etf

In addition, you may benefit from Augusta's buyback policy. However, buyback costs might differ, and regulations prohibit the company from making buyback guarantees. Augusta touts life time support (self directed ira). Its track record gets an increase from its client testimonials and leading marks from the Better Organization Bureau and business Customer Alliance.

The company helps diversify investment portfolios through IRAs backed by silver or gold and provides valuable metal purchases (best gold stocks). Noble Gold's representatives will gladly walk you through prospective financial services without any tough sell or high-pressure strategies. Noble Gold stakes its claim for incredible service on three main aspects: competence, dependability, and friendliness.

The Noble goal includes not only safeguarding wealth however using its knowledge and skills to build value for its consumers. Investment knowledge would be a given for a business of this quality, however the Noble group's abilities go deep. These abilities couple with a company-wide dedication to treating its customers with kindness and sincerity that makes you feel like you're buddies and teammates on your retirement financial investment path.

Best Way To Invest In Gold 2022

They believe in offering top quality, friendly guidance. Noble Gold has a great relationship with other experts in the market, so if you require a service it does not provide, the team will gladly provide a referral. The company includes a basic, three-step process to safeguard your retirement finances using a gold IRA.

The company selects realities and comprehending over slick sales techniques and market jargon. When you acquire an education on valuable metals IRAs, you can make better financial investment decisions. Next, you'll communicate with a trusted consultant who has the experience and knowledge vital to serving your requirements and helping you meet your objectives.

The Noble Gold website claims that the business's access to a variety of providers enables it to offer the most competitive rates and the finest offers in the market. The company features gold IRAs along with gold, silver, platinum, and palladium coins and unusual coins. When clients' circumstances alter, they can benefit from Noble's no-quibble buyback program.

Directed Ira

# 5 Regal Assets: Purchase Gold Bars and Coins at Affordable Costs You'll seem like royalty when you work with Regal Assets. The business has actually boasted the leading score in the rare-earth elements market for a decade (best way to invest in silver). The Regal Assets business is relatively young, first hitting the marketplace in 2010.

Rather of complex administration and challenges, Regal Assets pictured simpleness and innovation. Regal Assets continued, acquiring substantial limelights from usually traditional outlets like Forbes and Bloomberg, to call a couple of. It has also racked up fans, fans, and plenty of favorable reviews from users, along with an A+ from the Bbb and an AAA score from the Organization Customer Alliance.

Devoted to the different, Regal Assets concentrates on offering customers the ability to diversify their portfolios with alternative financial investments by turning the conventional into gold (or crypto). As its site states, "Maintaining an almost flawless track record profile is no simple job." Regal Assets remains in high regard through a client-first approach.

Goldco

Regal Assets thinks in transparency regarding commissions and charges, however its staff member don't believe in the difficult sell of higher-cost products to increase the company's take. Your distinct needs and goals come before dollars in worker incomes. It's easy to get going if you desire the royal treatment from Regal Assets.

A Regal Assets account specialist will connect to you to help complete your setup, then you can money your gold IRA. Regal Assets offers tough assets in the type of gold, silver, platinum, and palladium bullion. If you're feeling truly adventurous, you can likewise go digital and purchase some crypto for your golden years.

How much gold is a good investment?

10%. One rule of thumb is to keep gold to no more than 10% of your overall account value. Gold has previously moved in the opposite direction of the U.S. dollar, so some investors use it as a hedge against inflation.

Will gold price go down in 2022?

Joni Teves of the investment bank explains why the strength of gold is "ultimately short-lived" and discusses the factors that are part of its "negative backdrop."

Should I buy silver or gold now?

The best candidates for silver investments: Have a Total Portfolio Value of Under $35,000. Silver comes with a much lower price per once and is therefore more accessible than gold. Those just starting out with relatively small investment portfolios will likely be better served choosing silver over gold.

How do I invest in gold stocks?

Return rates of physical gold are never profitable if you invest in the gold jewellery. The reason being that the price of jewellery is not only determined by the gold rates but it also includes the making charges and this is the just the half story i.e. when you purchase the gold.

Discuss your level of convenience with these IRAs with your Regal Assets rep. The business has a reputation for customer-friendly prices, though costs might vary. Regal Assets might provide no rollover fees and totally free storage for the first year, as it has in the past. If Regal Assets is on your shortlist for gold individual retirement account companies, we advise that you connect for the most present pricing and promos (gold ira investing).

Best Gold Ira Companies 2022: Reviews, Ratings, Complaints

With royal customer care treatment, easy access by means of phone or online chat, and potential crypto experience, Regal Assets uses gold Individual retirement accounts to facilitate your retirement security. What Is a Gold IRA? Individual retirement accounts or Individual retirement accounts are absolutely nothing brand-new. These cars safeguard money to fund your retirement. Generally, these instruments have actually held assets like money, stocks, or bonds.

These self-directed IRAs have actually allowed financiers to pick gold or other valuable metals like silver, platinum, and palladium to back the product. Other self-directed Individual retirement accounts include possessions like genuine estate, cryptocurrency, or art. Like standard IRAs, you can contribute to a gold individual retirement account on a pre-tax basis and grow worth in a tax-deferred way.

These alternative paths to financial security as a senior citizen tend to be slightly more intricate than conventional IRAs. The gold and other valuable metals you may choose requirement to meet the Internal Income Service's exacting standards for fineness. Internal revenue service guidelines do not permit all gold products; just particular coins, bars, and bullion meet the IRS requirements.

Gold Ira Rollover: 19 Essential Facts To Know Before You Invest

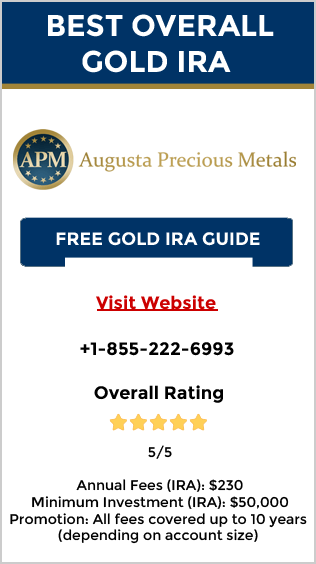

You should store the rare-earth element that backs your individual retirement account in an unique depository, so it resembles buying gold without possessing it. These centers must have internal revenue service approval. Usage of a storage center that does not hold internal revenue service approval might lead to disqualification of your gold IRA. Along with the more complex nature of handling your gold IRA comes higher charges than conventional IRA items.

These gold individual retirement account companies typically charge setup, administrative, and storage fees, in addition to commissions. gold companies to invest in. The benefit to gold Individual retirement accounts is that they assist safeguard versus inflation and provide a method to diversify your retirement portfolio. An extremely qualified gold individual retirement account company can assist you maximize these alternative financial investments.

While you may discover numerous other gold individual retirement account investment business out there, these firms have impressive track records, substantial experience in the market, and client reviews showcasing extraordinary service. Credibility and Reviews Endorsements from celebs or huge names in finance will capture your eye, however we desired to understand how regular people feel about these gold IRA companies.

How To Choose A Reliable Gold Ira Company - 2022 Guide

Each of the companies received an A+ rating from the Better Organization Bureau. If big names or media points out drew you in, that's great. These golden business have a solid reputation to support their star power. Reduce of Setup Retirement funds are crucial to your future. You desire to make certain you can live comfortably after you have actually turned in the secrets to your workplace.

However, that doesn't indicate you require the preparation process to be ineffective and lengthy. All of the gold IRA business on our list make your gold IRA setup as basic as possible, with agents to assist you each step of the way. So whether you start the golden journey on the website or with a telephone call, you'll get expert advice and help.

click for more info read review this link look here